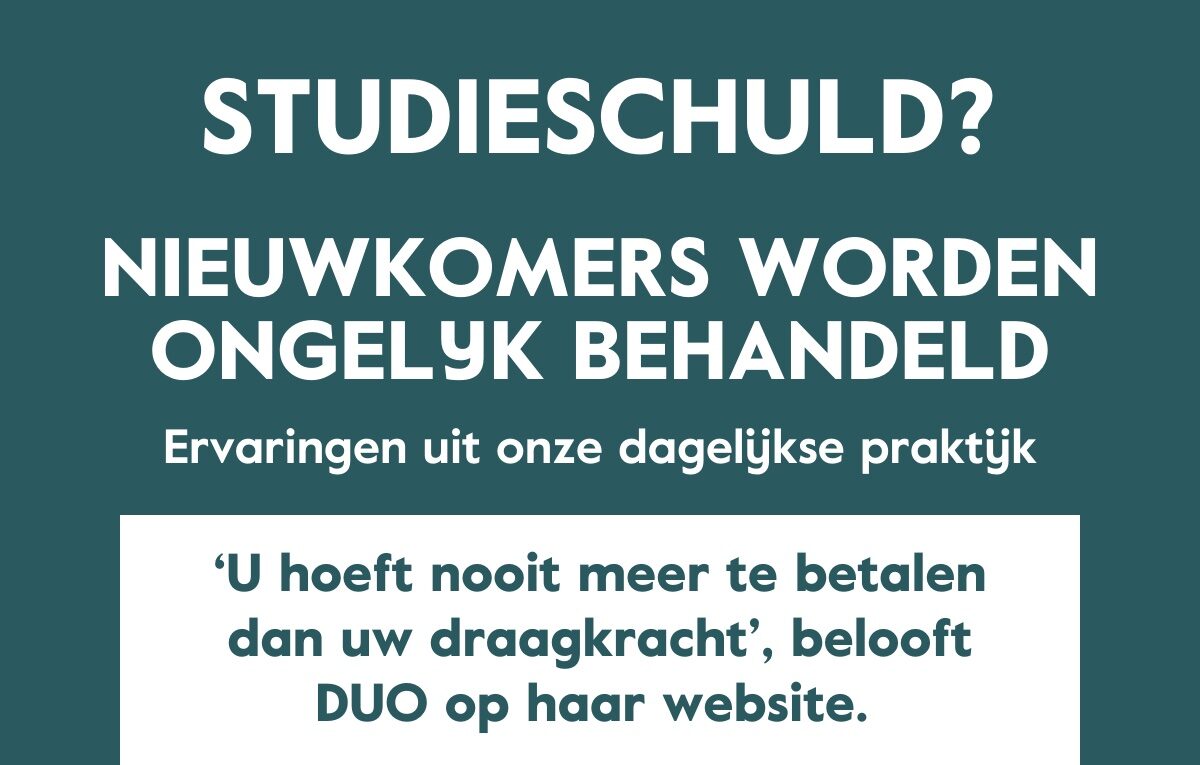

"You will never have to pay more than you can afford," promises DUO on its website. Sounds logical, right? This promise is aimed at people who have to repay their "regular" student loans. Strangely enough, the same promise does not apply to the student loans of newcomers who have to repay their integration loans.

Is it financially feasible?

Together with someone who has completed the integration program, we call DUO. He completed the program under the old Integration Act and will soon start repaying his DUO integration loan. He is concerned about the amount of his monthly student loan repayments. Providing for a family with two young children can be financially challenging.

The DUO employee explains how the monthly repayment amount for the student loan is calculated. The following factors are taken into account:

- The amount of the debt

- The repayment period and

- The interest rate

No assessment is made as to whether this monthly amount is financially feasible for the family.

Apply for a ‘financial capacity assessment’

Newcomers must apply for a 'financial capacity assessment' themselves. This is a bureaucratic process that not everyone who has become a citizen is familiar with. Furthermore, this application does not guarantee that the monthly amount will remain financially feasible in the future.*

Newcomers with student debt are therefore likely to be repaying more each month than is financially fair. This applies to newcomers who were integrated under the old law and now have to repay their loans.

Legislative amendment proposed

A legislative amendment has been proposed to change this problematic situation. But even with the proposed change, inequality will remain. The promise that "you will never have to pay more than you can afford" will only apply to those repaying a "regular" student loan.

Student debt for newcomers? You can help bring about change.

Respond to the legislative amendment before June 29.

If the monthly amount turns out to be too high, it will be reduced. Every year, an automatic reassessment will be carried out to determine whether a reduction is justified. If the reduction is no longer justified, the annual reassessment will cease. There will be no further automatic reassessment of whether a reduction would be justified in the future.

If the monthly repayment amount is not too high, nothing will change.

In both cases, the following applies: If the income changes in the future, the borrower will have to reapply for a financial capacity assessment.

How do you make an impact?

Respond to the proposed legislative amendment!

The legislative amendment (see 4. Ex officio means test) proposes: Automatically perform a means test at the start of the repayment process. This is a step forward, but it is not enough. We therefore proposethe following two points for the student debt of newcomers:

1) The means test must be carried out every year as standard.

This is the case for repayers of a 'regular' student loan. It should also apply to repayers of an integration loan. The amendment to the law only proposes a means test at the start of the repayment process. So, first a (desirable) monthly repayment amount is determined, taking into account:

- The amount of the debt

- The repayment period

- The interest rate

A financial capacity assessment is then carried out automatically.

Then there are two possible situations:

1) If the (previously determined) monthly amount turns out to be too high, it will be reduced.

Every year, an automatic reassessment will be carried out to determine whether the reduction is still justified. If the reduction is no longer justified, the annual reassessment will be discontinued. A new financial capacity assessment will only be carried out if the borrower requests it.

2) Is the (previously determined) monthly amount NOT too high? Then the situation remains unchanged. A new affordability assessment will not be carried out automatically. In this situation too, the borrower will have to apply for a new affordability assessment if their income changes.

Because the means test is not automatically repeated every year, there remains a risk that newcomers will pay more than is financially fair.

Point of attention for providing information about the law

2) More accessible information about the calculation of financial capacity and the amount of the monthly payment.

The information about this on inburgeren.nlis limited. There is also no calculation tool that people can use to estimate the monthly amount themselves. This calculation tool does exist for people with a 'regular' student loan.

We call on implementing bodies to actively and accessibly inform people about their repayment options and their rights. This requires an active and well-considered approach.